Many times throughout the week I encounter Lodgix.com customers that are not using best practices when it comes to guest reservations and invoicing. As a vacation rental owner myself, I cannot fathom how a vacation rental business owner can manage their business effectively if they aren’t accurately recording the payments and refunds associated with each rental.

Each invoice has a status, that status can be:

1) Unconfirmed

2) Confirmed

3) Paid-in-Full

4) Refund Owed

An invoice is in an unconfirmed state of the guest has not paid the reservation deposit requirement which must always be setup within the Universal Rules area of the application. For most properties, the reservation deposit requirement is 50% of the rental charges or 100% if the rental is <30 days to arrival.

For example, if today is January 7th and a reservation is made today with a June 7 arrival date, then 50% of the rental charges would be due now to make the reservation. The invoice will remain in an unconfirmed status until the 50% is paid. THE INVOICE WILL ALWAYS TELL YOU WHAT PAYMENT AMOUNT IS REQUIRED TO BRING THE INVOICE TO A CONFIRMED STATUS.

All invoices with an "Unconfirmed" status are displayed in the pending reservations area of your dashboard. There should never be reservations that are in the past with an unconfirmed status. That means you as a business owner are not matching the real world transaction with the invoice transaction, and it will make your vacation rental accounting very difficult in the long term.

The invoice is always your point of reference. If you receive a check in the mail for a payment, it must be recorded against the correct invoice. If you owe a security deposit refund to a guest after departure it must both be matched against the invoice and recorded within the invoice to ultimately bring that invoice to zero.

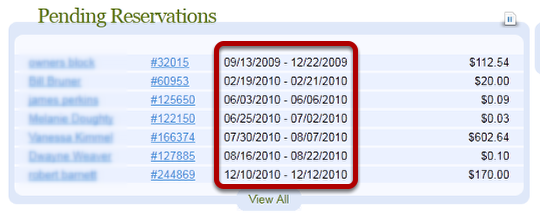

Pending Reservations Example (BAD)

This is an example of a property owner who is NOT CLOSING OUT EACH INVOICE AND BRINGING IT’S BALANCE TO ZERO. If today is January 7th, 2011, then every single one of these reservation is in the past and these all show that the guest still owes the property owner money. I know this because the reservation is in a pending status, which means that the reservation is in an "Unconfirmed" status, which means that the guests owes me money to confirm the reservation. But that can’t be true, because these reservations are over!!! So either the property owner did not collect enough money (unlikely) or the property owner collected the money and failed to record it correctly on the invoice (likely).

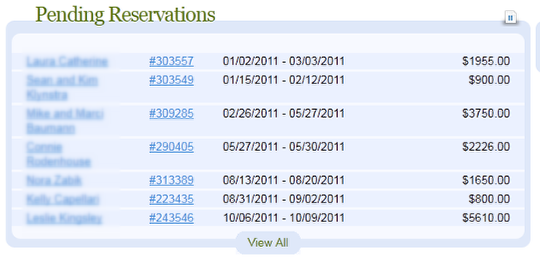

Pending Reservations Example (GOOD)

The property owner is using best practices. If today is January 7th, 2011, all of his reservations are in the future. That means each of those reservations has yet to occur and are not confirmed because the property owner is awaiting payment or has received payment and has not had time to record it (check, cash, etc.)

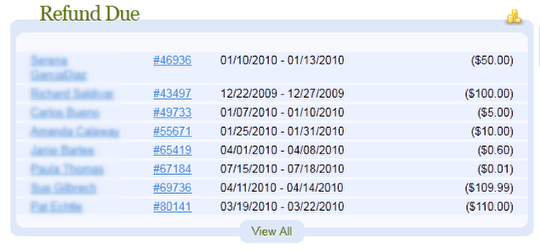

Refund Due (BAD)

This property owner has a lot of reservations that are showing as being owed a refund. Some of these invoices are from early 2010. It is highly unlikely that the guest has not received their refund because the property owner would be in a lot of hot water if they were intentionally not refunding security deposits. It is more likely that the property owner experienced some damage and refunded only a portion of the security deposit or simply failed to record the refund at all. If only a portion of the deposit was refunded, then the remaining amount which the invoice shows as being owed to the guest needs to be countered by adding a "breakage fee" to the invoice and applying it versus the deposit amount that is showed as being owed.

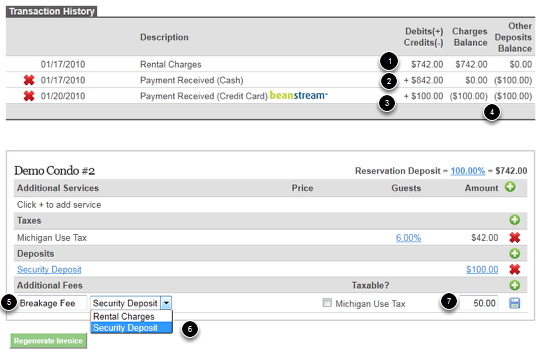

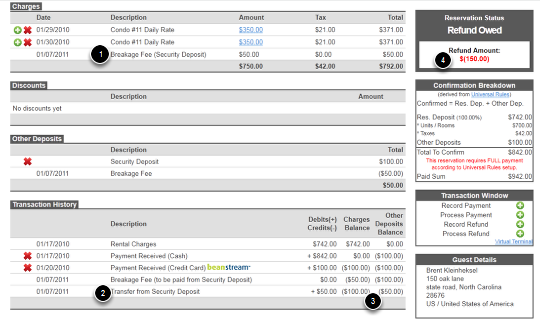

In this example, the property owner $742.00 in rental charges (item #1) that are due + payment of the $100.00 security deposit, so $842.00 is due (item #2). However, for some reason the property owner processed another payment of $100.00 (item #3), resulting in a credit balance in both the rental charges and the other deposits columns. Thus the guest is currently owed $200.00

The guest departs and the property owner see that the guest broke an expensive lamp and did not report it. Per the property owner’s policies she wants to retain $50.00 of the $100.00 security deposit and must update the invoice appropriately.

In item #5 she creates a new fee and calls it a "Breakage Fee" and then choose to assess the fee against the security deposit (Item #6). IT IS VERY IMPORTANT IF YOU ARE WISHING TO REDUCE THE AMOUNT OF SECURITY DEPOSIT REFUNDED that you first create a fee and assess the charge against the security deposit and not rental charges. In step #7 she sets the amount of the fee at $50.00.

The result is that you can see that a breakage fee has been added to the invoice for $50.00 (item #1), but has been paid for from the security deposit monies already collect (item #2) and thus all that is owed to the guest is the remaining $50.00 of the security deposit and the $100.00 which the property accidentally overcharged the guest (item #3) resulting in a total credit due to the guest of $150.00 (item #4).

Guest Refunds

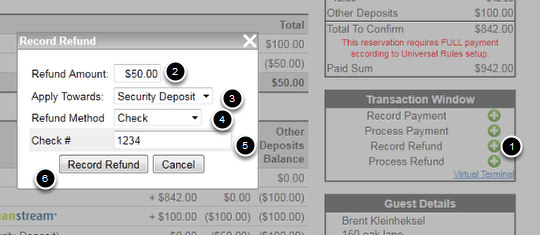

Because the property owes the guest a refund for both the security deposit ($50.00) and an overpayment of rental charges ($100.00) two separate refunds must be recorded to bring this invoice to zero balance.

Step #1: Press the Record Refund icon

Step #2: Enter the amount of the refund

Step #3: Choose whether to apply the refund towards the security deposit or rental charges

Step #4: Choose the refund method

Step #5: If via check, record the check # of the refund

Step #6: Press "Record Refund"

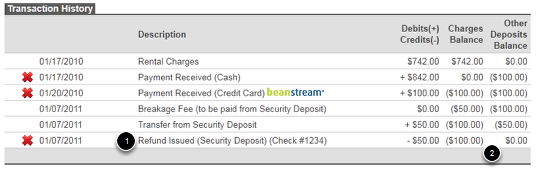

The transaction history of the invoice will update and you can now see that the balance of the Other Deposits column has been reduced to zero after the security deposit refund has been recorded. Now all that is left is to issue another refund for $100.00 and apply it towards the rental charges balance.

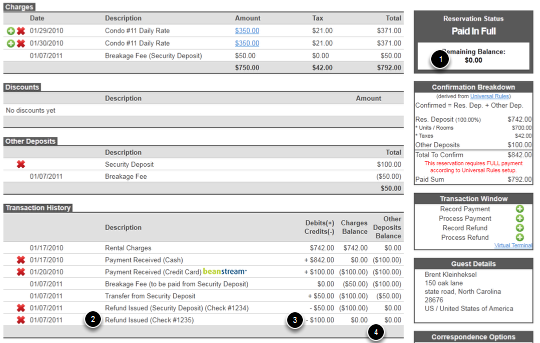

The final invoice now accurately reflects what transpired with this particular guest. The invoice now has a zero remaining balance (item #1) and reflects the rental charges refund due to the overpayment and both the rental charges and the security deposit accounts have a zero balance.

This invoice is done!!